SVP Products

The tone at the Mortgage Bankers Association (MBA) Annual Conference was unmistakably different this year. For the first time in several cycles, conversations shifted away from simply weathering market pressures to actively preparing for growth and appraisal modernization.

There was a clear sense that we’re entering a new phase, one where macro stability is beginning to return, and technology, especially AI-driven workflow automation, is moving from concept to operational reality. What stood out to me was the collective mindset: Lenders, AMCs, and tech partners are no longer talking about innovation in theory; they are building it, investing in it, and measuring its outcomes. From market forecasts to efficiency strategies and AI adoption paths, the conference offered a grounded, forward-focused picture of where the mortgage industry is heading and how to lead in this next phase.

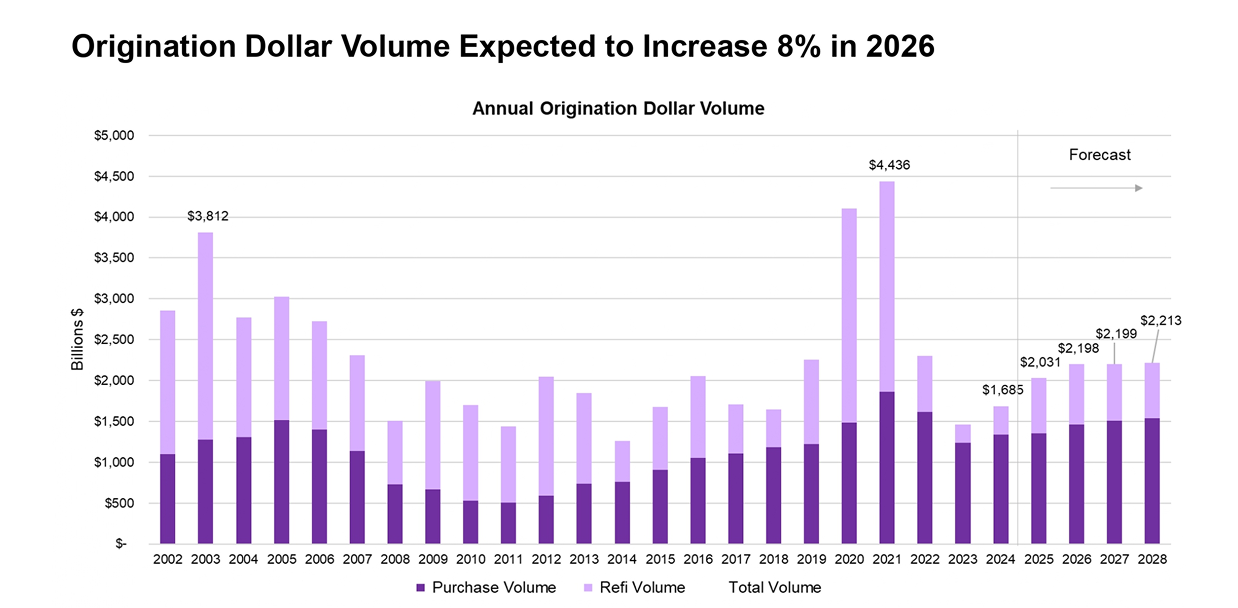

The Mortgage Bankers Association expects a steady rebound in lending activity, with single-family mortgage originations projected to grow about 8% in 2026, reaching roughly $2.2 trillion from $2.0 trillion in 2025. It’s a sign of gradual market strengthening rather than a sharp surge.

When reviewing the origination curve, the signal was clear, a controlled, upward slope extending from 2024 through 2026. No sharp spikes, no inflated optimism, just steady, confidence-building progress grounded in fundamentals rather than rate-driven volatility.

This recovery is being supported by:

All macroeconomic market data and visuals referenced in this article have been extracted from the Mortgage Bankers Association’s 2025 Annual Conference presentation.

Source: MBA Forecast: www.mba.org/forecasts (MBA Market Outlook 2025)

We’re not seeing a sudden boom, it’s a healthy climb. With refinance expected to grow 9.2% to $737B, Lenders prepared to modernize will be the ones who capitalize.

It’s evident that the economy continues to move in the right direction, but at a measured pace rather than a rapid expansion. MBA economists are projecting U.S:

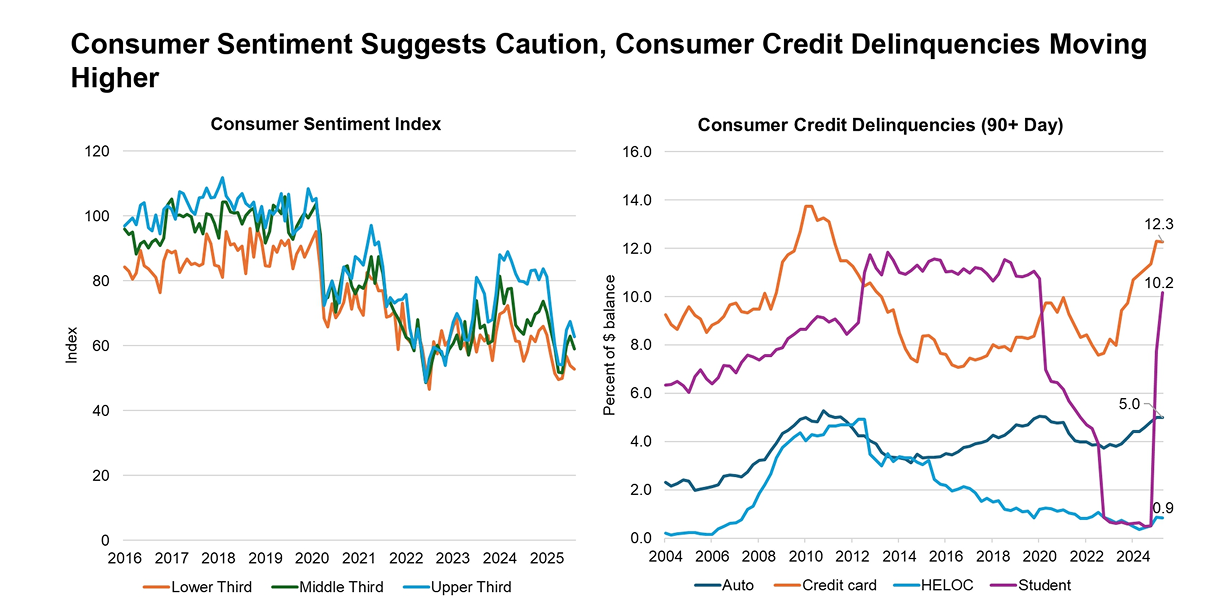

The consumer sentiment and delinquency data painted a similar picture: confidence remains subdued and credit delinquencies are beginning to inch higher, particularly in credit cards and auto loans. This aligns with what many of us are sensing in the market, consumers are more selective and financially cautious than they were a year ago.

Source: University of Michigan, New York Fed (MBA Market Outlook 2025)

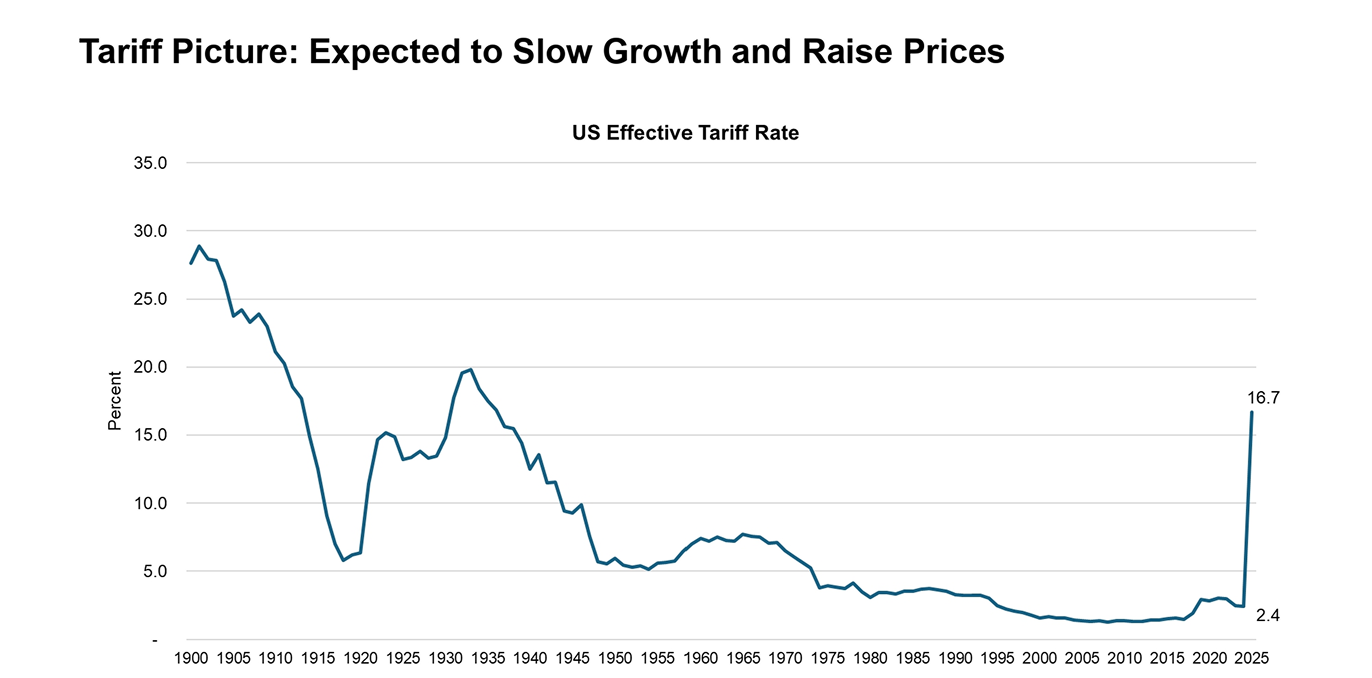

One factor that stood out to me was the renewed discussion around tariffs and global economic uncertainty. The tariff chart showed a noticeable spike, highlighting the potential for trade policy to add upward pressure on prices. It was emphasized that inflation relief will likely be slow and uneven, and policy decisions in the coming months, especially with the political environment as it is, may play a meaningful role in shaping cost structures and overall economic stability.

On the rate side, the sentiment across panels was consistent: while MBA forecasts indicate roughly 75bps of rate cuts ahead, we should expect mortgage rates to stay higher than pre-2022 levels for the foreseeable future. The overarching message is that this is a “higher for longer” environment, and Lenders should not base strategy solely on hopes of aggressive rate declines. Instead, the focus needs to remain on operational efficiency, borrower support, pricing flexibility, and scalable infrastructure to compete effectively in this climate.

Source: Peterson Institute for International Economics, Yale Budget LabFed (MBA Market Outlook 2025)

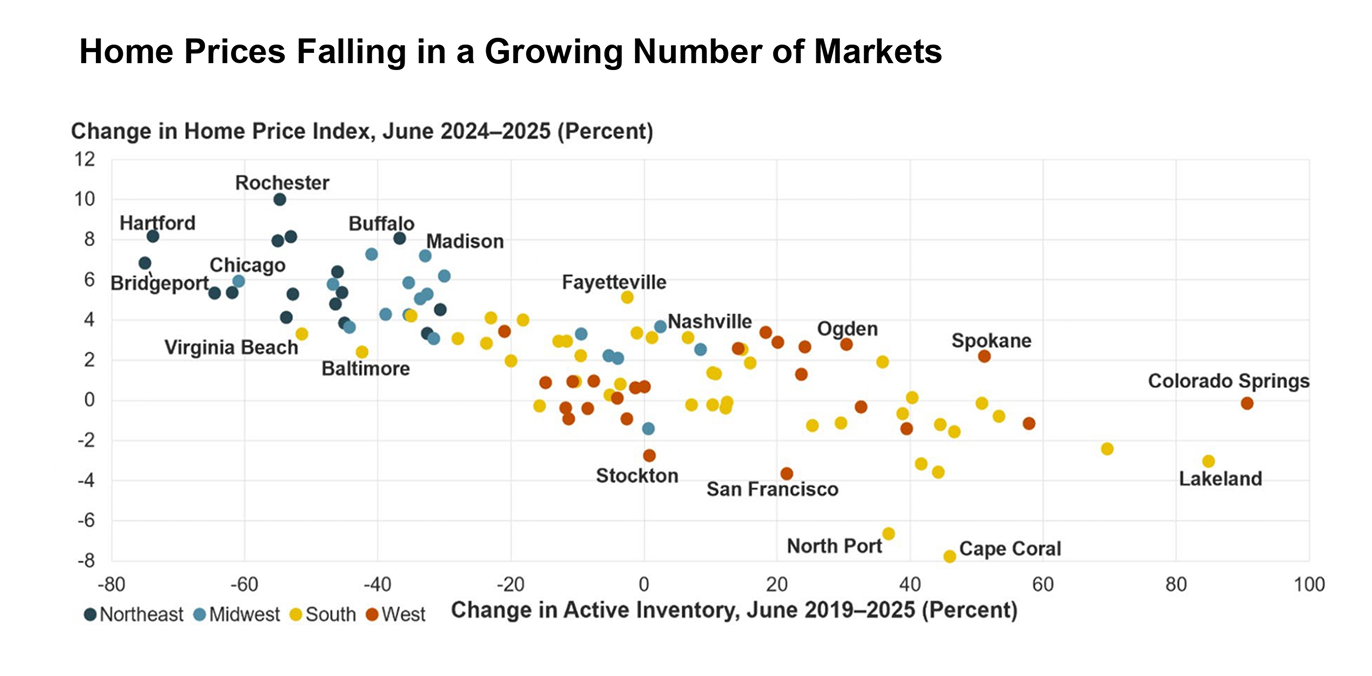

The housing market is entering a phase of gradual normalization.

The Northeast remains the rare exception where prices continue to climb, driven by supply constraints and persistently strong demand.

Source: Joint Center for Housing Studies, Realtor.Com, Freddie Mac (MBA Market Outlook 2025)

Looking at the housing market data, it’s clear we are moving into a more balanced environment. The price-trend chart showed an increasing number of markets where prices are either stabilizing or seeing slight declines, a noticeable shift from the uniform appreciation of the pandemic years. It’s not a correction; it’s a normalization, and in many ways, a healthier one. The numbers reflecting affordability reinforce this. Median principal-and-interest payments are gradually easing, not because of major rate drops, but due to improving supply and more realistic pricing. Buyers are finally catching a bit of breathing room. This tone of stability rather than volatility was consistent across sessions. For Lenders and valuation partners, the message is straightforward: success will increasingly rely on local market insight, flexible pricing strategy, and the ability to move quickly where inventory improves first. The markets are shifting, and the advantage will go to those who can read and respond to those shifts fastest.

A clear theme at this year’s MBA conference was that AI has moved from theoretical conversation to operational reality. Unlike last year, where discussions centered on potential use cases, this year Lenders showcased live production deployments and efficiency wins driven by automation.

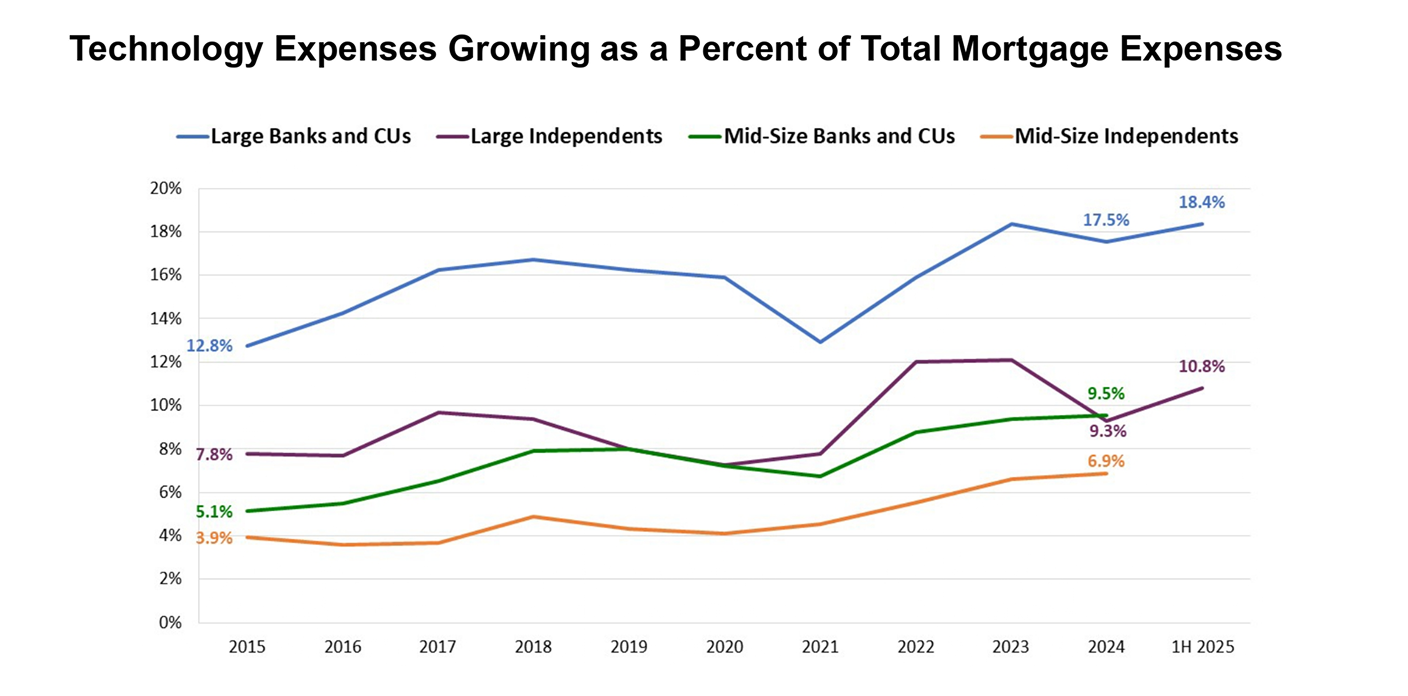

The data reinforced this shift. As highlighted in the tech-spend trends (Slide 39), technology now accounts for 10%-18% of operating expenses for large Lenders, a signal that digital infrastructure and automation are becoming core cost centers, not optional investments. More broadly, private-sector AI investment in the first half of 2025 is 3x higher than any other category and 4–5x higher than 2023–24, marking a decisive industry pivot AI appraisal management.

Source: PGR: MBA and STRATMOR Peer Group Roundtable Program http://www.mba.org/pgr (MBA Market Outlook 2025)

That said, adoption in direct lending operations still lags: 65% of leaders report familiarity with AI, but only 7% are actively deploying it. Based on the conversations at MBA, this gap is expected to narrow quickly as teams shift from experimentation to measurable ROI.

Across sessions, three priority buckets continued to emerge:

AI is no longer optional infrastructure for Lenders aiming to scale efficiently and compete on speed, accuracy, and cost.

At ValueLink, we have been investing in this direction for years. Our focus remains on building practical, trusted AI capabilities that enhance accuracy, speed, and decision support across real estate appraisal workflows. A good example is Photo AI for CrossCheck, already helping clients strengthen QC and reduce manual review time. We are continuing to layer intelligence into our ecosystem with a balanced, security-first approach that puts reliability and compliance at the forefront. Similarly, Cogent now brings AI-driven fee recommendations powered by historical data and industry trends, helping Lenders and AMCs make fair, data-backed pricing decisions and stay competitive in changing market conditions.

Moving through the operational aspects, the industry is recovering, but efficiency is still lagging behind where it needs to be. Yes, profitability has climbed off the lows of 2021, but cost-to-originate is still stubbornly high, largely because many Lenders are still wrestling with legacy systems, manual workflows, and fragmented tech stacks. The data showed progress, but not the kind of step-change productivity shift we need for the next cycle.

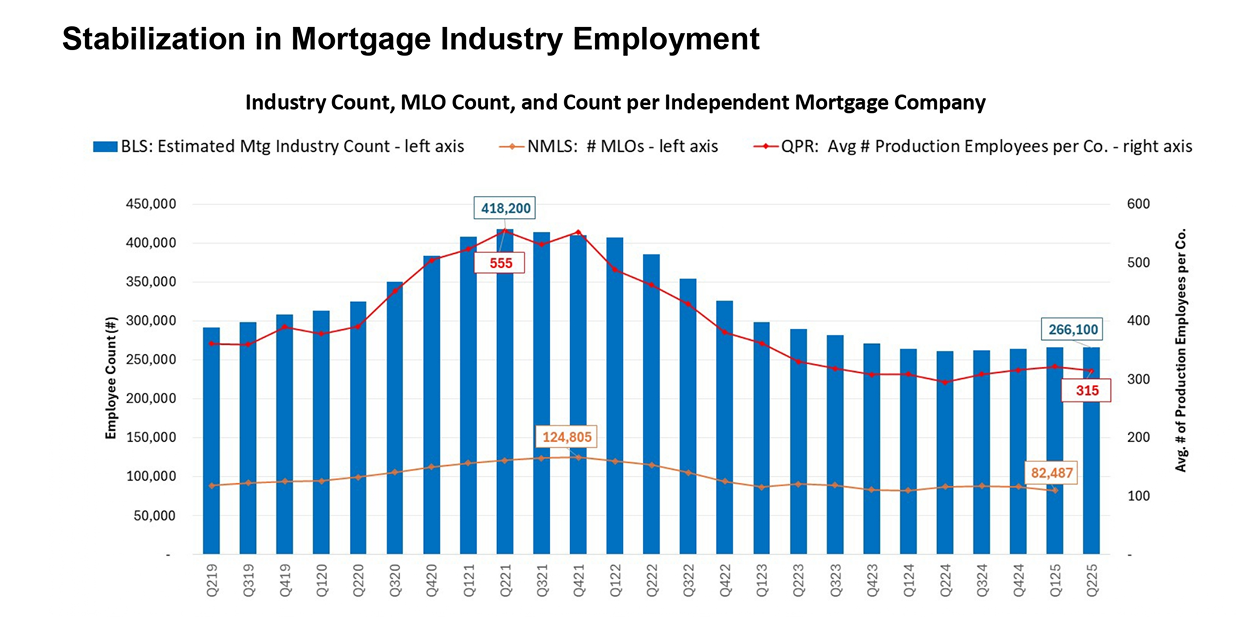

The employment chart reinforced this story. After a steep contraction in headcount over the last couple of years, the mortgage workforce has finally stabilized. We’re no longer in cost-cut survival mode but we also can’t simply rebuild the way we operated before. It’s straightforward, the winners will be the Lenders who scale through technology, not headcount.

That means:

In other words, we’re entering a growth phase but it’s a disciplined growth phase, where operational design and intelligent tooling will matter just as much as market conditions.

Sources: Bureau of Labor Statistics (BLS), Nationwide Multistate Licensing System (NMLS), MBA’s Quarterly Performance Report (QPR) (MBA Market Outlook 2025)

This year’s MBA felt like a turning point. Not the euphoric kind rather the practical kind. The industry understands where it needs to go, and the groundwork is being laid right now. Our focus is to align with that momentum: modernize with purpose, deploy AI responsibly, and build infrastructure that scales without compromising trust, compliance, or experience. The next phase won’t be about speed alone, it will be about clarity, capability, and execution. And those who start building for that future today are going to be ahead when the cycle fully turns.

If you’d like to exchange perspectives or explore practical modernization paths, I’m always open to connecting.

Buyers are becoming more strategic and less reactive. With affordability slowly improving and price pressure easing, many borrowers are timing decisions based on incremental rate improvements and equity positions.

Refinance behavior mirrors this: borrowers are watching the market closely and planning to act when modest shifts create opportunity.

AI is showing the most immediate value in:

The message from MBA was clear, AI has moved past experimentation. The organizations winning today are deploying targeted automation that removes manual friction and accelerates loan manufacturing, review, and communication cycles.

Traditional tech ROI thinking is evolving. The most effective lenders are no longer measuring value only by “cost savings” they are looking at speed, scale, accuracy, and decisions driven by data.

Key metrics include:

This is exactly why workflow intelligence tools are gaining traction across the industry. For example, our Cogent platform gives lenders and AMCs deeper visibility into turn-time patterns, stage-wise bottlenecks, and performance metrics, making it easier to optimize throughput, allocate resources strategically, and strengthen ROI. The goal isn’t just automation, it’s operational clarity that drives profitable execution.

Policy remains a variable, but most experts — including those at MBA — expect stability with incremental adjustments, not sweeping change.

Key watch areas:

Markets are not pricing in dramatic shifts; measured policy adjustments paired with gradual rate stability are the base case.

© 2025 ValueLink and all related designs and logos are trademarks of ValueLink Software, a division of Spur Global Ventures Inc.